Real estate investment presents a popular avenue for generating passive income or realizing profits. Nonetheless, unconventional or challenging properties often go overlooked by many investors. These properties are frequently perceived as too risky and not worth the consideration. However, in Gladewater, there exists a plethora of properties categorized as unconventional or problematic, yet this doesn’t necessarily warrant their dismissal. Here are five compelling reasons to contemplate investing in such properties.

- Attractive Acquisition Cost

One of the primary advantages of investing in unconventional or problematic properties lies in their typically lower acquisition costs. These properties may exhibit issues requiring resolution, like structural flaws or outdated elements, which can discourage other potential buyers. Consequently, sellers might be more inclined to negotiate on the selling price, creating an opportunity for purchasing at a low cost and realizing gains after enhancements.

- Amplified Profit Margins

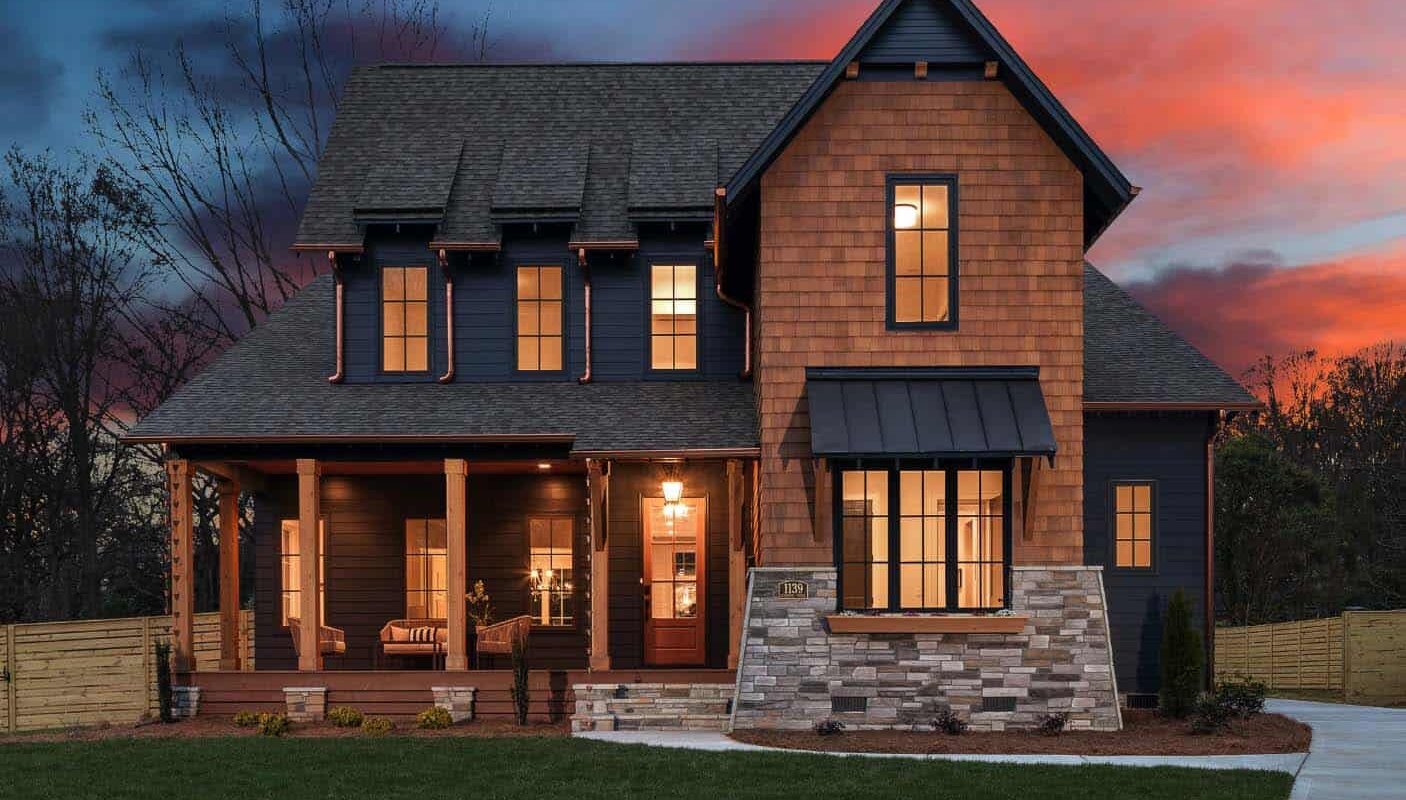

Acquiring an unconventional or problem property affords the chance to enhance its value through renovations and upgrades. This potential augmentation translates into a higher resale value, consequently yielding greater profit margins. With judicious improvements, a problematic property can transform into an appealing option, attracting buyers willing to pay a premium for a turnkey home.

- Distinctive Investment Prospects

Investing in unconventional or problematic properties introduces unique investment prospects that might be absent in conventional properties. For instance, you could come across a foreclosed property available at a discount. Alternatively, a property might have lingered on the market, enabling you to negotiate a reduced price.

- Portfolio Diversification

Incorporating unconventional or problem properties into your real estate portfolio contributes to diversification. This diversification mitigates overall risk by spreading investments across different property types. A diversified portfolio also enhances resilience against market fluctuations, as your investments won’t hinge on a single property category.

- Community Impact

Investing in unconventional or problem properties provides an avenue to effect positive change within your community. By acquiring a property in need of attention, you can uplift the aesthetic and ambiance of the neighborhood. This enhancement in property values contributes to making the locale more desirable for living.

Considerations…

When delving into investments involving unconventional or problem properties, several pivotal factors merit consideration. Firstly, conducting thorough due diligence and meticulous property evaluation before purchase is imperative. A comprehensive inspection aids in identifying potential issues that could impact the property’s value. Moreover, a well-defined plan for any intended renovations or enhancements is crucial. This safeguards adherence to budgets and ensures improvements augment the property’s value.

Financing constitutes another critical facet to address when investing in unconventional or problem properties. Traditional financing avenues might not apply, necessitating exploration of alternative financing options. Options such as securing a hard money loan to fund acquisition and renovation are worth considering.

For effective marketing and sale of your unconventional or problem property, spotlight the improvements undertaken. This attracts buyers in search of move-in ready homes and justifies a higher listing price. Professional staging and photography can further accentuate the property’s appeal.

Investing in unconventional or problem properties offers both financial rewards and personal fulfillment. These properties extend distinctive investment possibilities, lower purchase costs, amplified profit margins, portfolio diversification, and the ability to foster community enhancement. However, meticulous research and assessment of properties before acquisition are paramount. With diligent research and strategic planning, delving into unconventional or problem property investments can prove a lucrative method for expanding your real estate portfolio and generating passive income. At Texas Real Estate Investors, we are equipped to assist you in identifying ideal properties to enrich your portfolio. Contact us today to explore more! 903-402-1199